Stage 3 Tax Cuts – Update from recent announcements

As a follow up to our recent article about the Stage 3 Tax Cuts, we want to bring to your attention some additional changes that have been announced by the Government.

The purpose of these recent changes is to improve the benefit to those earning less than $146,486 and decrease the benefit to those earning above that amount.

UPDATE: These changes to the Stage 3 tax cuts were passed through legislation in late February 2024.

The below summarises the effects from the 2025 financial year, excluding the Medicare levy:

| Income Range | Tax rate 2023-24 | Tax Rate 2024-25 | Benefit | |

| $18,201 – $45,000 | 19% | 16% | 3% above $18,200 | |

| $45,001 – $120,000 | 32.5% | 30% | $804 + 2.5% above $45,000 | |

| $120,001 – $135,000 | 37% | 30% | $2,679 + 7% above $120,000 | |

| $135,001 – $180,000 | 37% | 37% | $3,729 | |

| $180,001 – $190,000 | 45% | 37% | $3,729 + 8% above $180,000 | |

| $190,001+ | 45% | 45% | $4,529 | |

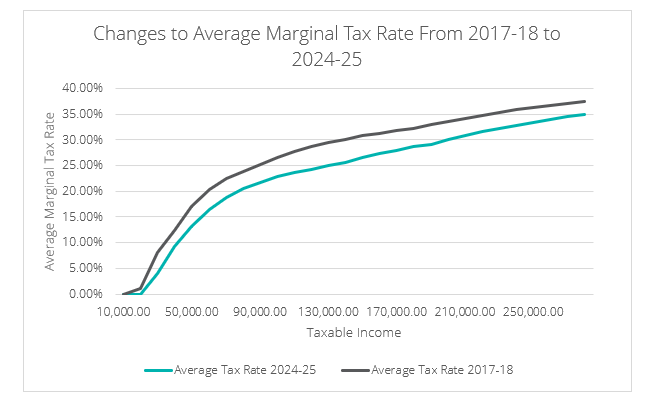

Whilst the announced changes effectively increase the tax payable for those earning above $146,486 compared to the previous approach to the stage 3 tax cuts, those taxpayers are still receiving a benefit compared to the 2023/24 rates. Since the tax changes began on 1 July 2018, the following displays the reduction in average tax rates all taxpayers average rate of tax:

The effect of the proposed tax changes to lower the average tax rates of individuals has increased the potential to distribute small business income directly to individuals and reduce distributions to corporate beneficiaries from trusts. This however is the opposite for any other income sources that would be taxed at 30% by a corporate beneficiary, due to the significant proposed changes to individuals earning above $146,486.

A highlight of the proposed changes below shows the taxable income that an individual may earn whilst achieving the same tax rate that a corporate entity may be able to achieve.

| Average Marginal Tax Rate | Taxable Income 2017-18 | Taxable Income 2024-25 (Previous Stage 3) | Taxable Income 2024-25 (Proposed Stage 3) |

| 25% | $88,343 | $120,114 | $131,600 |

| 30% | $137,423 | $225,929 | $199,188 |

We encourage you to discuss the above with your WLF Advisor who can detail what the changes mean for you and apply solutions to meet your personal circumstances.

Please note: as indicated above, these recent announcements on tax rate changes are not yet legislated and may be subject to further change.