Tax cuts taking effective from July 2024

UPDATE: The Government has announced some changes to the Stage 3 Tax Cuts, which are still to go through legislation. You can read the updated information here.

Commencing from the 2025 financial year, significant revisions will be made to individual marginal tax rates for those with taxable incomes above $45,000.

The most significant change is by removing the 37% marginal tax rate bracket and creating one marginal tax rate bracket from $45,000 – $200,000 at a rate of 30%. The amount of the reduction is summarised in the table below, excluding the Medicare levy:

| Income Range | Tax rate 2023-24 | Tax Rate 2024-25 | Benefit | |

| $45,000 – $120,000 | 32.5% | 30% | 2.5% above $45,000 | |

| $120,001 – $180,000 | 37% | 30% | $1,875 + 7% above $120,000 | |

| $180,001 – $200,000 | 45% | 30% | $6,075 + 15% above $180,000 | |

| $200,001+ | 45% | 45% | $9,075 | |

This is the third and final stage of the tax cuts which commenced on 1 July 2018, which have seen the following adjustments to the individual marginal tax rates and low-income tax offset (‘LITO’), excluding the Medicare levy:

| Income Range | Tax Rate 2017-18 | Tax Rate 2024-25 | Benefit | |

| $0 – $18,200 | 0% | 0% | Nil | |

| $18,201 – $37,000 | 19% | 19% | $255 (LITO Increase) | |

| $37,001 – $45,000 | 32.5% | 19% | $280 + 10% above $37,000 | |

| $45,001 – $87,000 | 32.5% | 30% | $1,080 + 2.5% above $45,000 | |

| $87,001 – $180,000 | 37% | 30% | $2,130 + 7% above $87,000 | |

| $180,001 – $200,000 | 45% | 30% | $8,640 + 15% above $180,000 | |

| $200,001+ | 45% | 45% | $11,640 | |

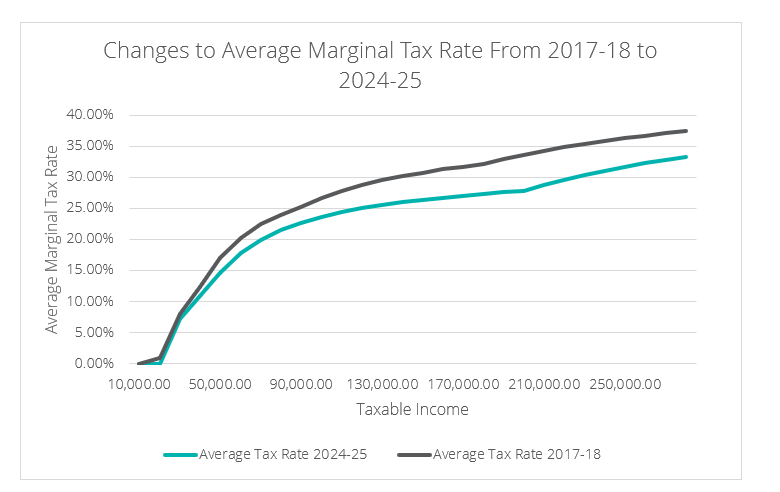

The difference between the average marginal tax rates is illustrated in the chart below. This is a significant tool for families with trusts, and those with corporate beneficiaries, in tax planning for the 2025 financial year.

The effect of the tax changes has ensured that there is less bracket creep. The changes have increased potential to distribute income directly to individuals and potentially reduce distributions to corporate beneficiaries from trusts.

A highlight of the changes below shows the significant increase in taxable income that an individual may earn whilst achieving the same tax rate that a corporate entity may be able to achieve.

| Average Marginal Tax Rate | Taxable Income 2017-18 | Taxable Income 2024-25 |

| 25% | $88,343 | $120,114 |

| 30% | $137,423 | $225,929 |

We encourage you to discuss the above with your WLF Advisor who can detail what the changes mean for you and apply solutions to meet your personal circumstances.

Please note: changes to individual marginal tax rates are announced during the delivery of the Federal Government’s budget and whilst the above is legislated, it may be subject to change. There are no future changes to income tax rates that have been announced as at the time of writing this article.