March 22 – 2nd COVID-19 economic stimulus package

Posted on March 22nd, 2020 by WLF

Today the Prime Minister and Treasurer scaled up their economic stimulus package to $189 billion (approximately 10% of GDP).

The measures will be delivered over the next six months and focus on those that will be the first to feel the economic hardship of this crisis. We expect that the Parliament will push through this stimulus package Monday or Tuesday and implement the measures as soon as possible.

You can find our overview of the 1st stimulus package here.

Some key points of the second package that we believe may be of particular interest to our clients are listed below:

Help for sole traders

- Expanded access to income support payments

- $550 Coronavirus supplement for those on income support payments

- Available to sole traders and casual workers who meet the income tests

- Waive the asset testing and reduce waiting times for access to JobSeeker and Parenting Payments

- The partner income test has been raised to $79,762

- A second payment of $750 payment for those not eligible for the Coronavirus supplement

- Payments will begin from 1 April

Easing cash flow for employers

- Scaling up the initial announcement of tax-free payments from $25k to $100k delivered as a credit on your activity statement

- Eligible businesses (and not-for-profits) will receive a minimum $20k cash payment in total

- First payments will be made from 28 April 2020. Additional payments from 21 July 2020.

- The payments will come in two tranches, the first tranche will be capped at $50k and be calculated based on employee withholding tax payments made to the ATO from January to June 2020

- Subject to the $50k cap, the first tranche payments will be equal to 100% of the withholding

- Monthly lodgers will receive 3 times the amount on their March activity statement

- The second tranche will be equal to the first payment and delivered during July to October

- Monthly activity statement lodgers will receive a quarter of the first tranche payment with each lodgement of their activity statements for July to September

- Quarterly activity statement lodgers will receive half of the first tranche payment with each lodgement of their activity statement

- Available to businesses with an aggregated turnover of less than $50m who have employees

- Only available to employers established prior to 12 March 2020, although new NFPs may be eligible

Commonwealth guaranteed loans for small businesses

- The government will guarantee 50% of unsecured loans of up to $250k per borrower for up to the next 3 years

- No repayments for first 6 months

- Loans to be used for working capital

- Eligible to business with aggregated turnover less than $50M

- Subject to eligible lenders’ credit assessment process with the expectation that lenders will not use current uncertain conditions as a barrier

- We encourage you to talk to your bank now to see what products are available for you

- Government to encourage lenders to provide draw down facilities that are interest free until actually used

- Start in early April and available for new loans made up to 30 September 2020

Early release of superannuation

- From April, eligible individuals will be able to access up to $20k of their own superannuation

- Maximum of $10k can be accessed before 30 June 2020

- A further $10k can be accessed from 1 July 2020

- Tax-free withdrawal and won’t affect Centrelink or Veterans Affairs payments

- Available if after 1 January 2020

- You are a sole trader whose business is suspended or has experienced a reduction in turnover of 20% or more

- Your working hours were reduced by 20% or more

- You were made redundant

- Also available to currently unemployed and those on some income support payments

- Make application online through www.my.gov.au

Support for retirees

- Reducing deeming rate on assets from 1 May 2020

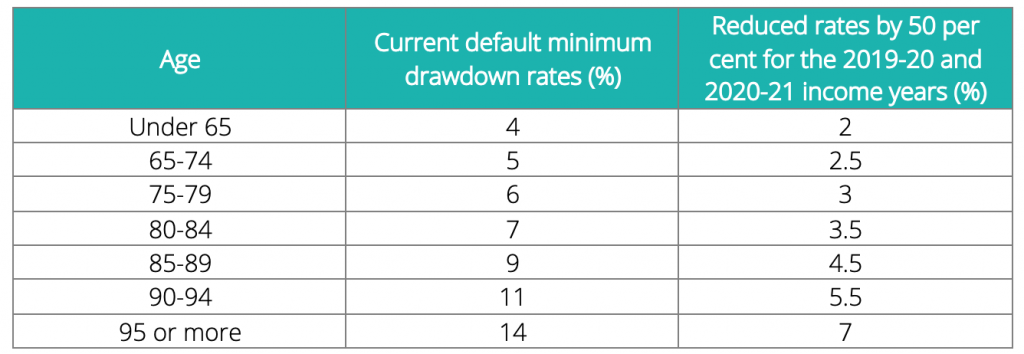

- Reducing the minimum draw down of retiree’s superannuation funds

- Reduction applies from the 2019-20 and 2020-21 income years

Temporary relief for financially distressed businesses

- Temporary increase the threshold at which a creditor can take action from $2k to $20k and giving businesses 6 months to respond (increase from 21 days)

- Temporary relief for directors from personal liability for trading while insolvent

Please contact your advisor at WLF if you have any concerns about any of these measures.

Below are some links to resources you may find useful

- Government overview of the second stimulus package

- Government overview of the first stimulus package

- Detailed information of the various measures

- TCCI have released COVID-19 Business Resources, including links and contact phone numbers for relevant government departments and information.

- More information for employers can be found here