Don’t let cashflow pressure get the better of you

“Never take your eyes off the cash flow because it’s the life blood of business” Richard Branson

As a business owner you know that cashflow is important, however the current inflationary pressures and higher interest rates are certainly putting some pressure on for many SMEs.

To help alleviate your cashflow struggle, we’ve provided some useful tips and processes that you can implement in your business:

- Enter supplier invoices into your accounting system upon receipt of the invoice – this will allow you to have a clearer picture of what is owing and when it falls due.

- Make full use of supplier payment terms – if a supplier offers generous payment terms, make full use of those terms, where appropriate.

- Get on the phone to chase up debtors – ensure that past-due debtors are chased up verbally, not just via email. Often better outcomes can be achieved by having conversations over the phone.

- Set a schedule for when the above administrative tasks are performed. Create a calendar of when tasks will be performed. If it’s not in your schedule it can easily be forgotten.

- Closely monitor stock/WIP levels – overspending on stock can put unnecessary strain on business cashflow.

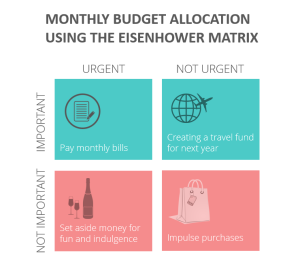

- Do you know of the Eisenhower Matrix for expenditure? It’s a simple but effective tool, as you can see here.

- Using this matrix, expenditure generally falls into 1 of 4 quadrants.

- Urgent and important expenditure requires the most attention.

- Non-urgent, non-important expenditure can be delayed in times of high cashflow pressure.

- Prepare and monitor a budget – setting and periodically reviewing a budget allows you to keep an eye on trends and take appropriate action.

- Reconcile your accounting file! We know this is a task that many people prefer to avoid, but it’s important so make sure you see it as a priority. Without an up-to-date file, you are essentially flying blind financially.

- Ask for help. If your business is struggling financially, reaching out to your advisors is a useful and pro-active first step.

- It’s important you seek advice to ensure you are adhering to director duties under the Corporations Act in relation to insolvent trading.

- A discussion with your accountant and advisor can present options to help make a change and get back on track.

Implementing these tips may take a little bit of planning but the outcome will be worth the time. These actions should help improve your cashflow and give you the best chance at succeeding and thriving in business during challenging economic times.

If you have any questions or would like to discuss your specific circumstances, please contact your WLF advisor.

Note:

If you are feeling overwhelmed or stressed to the extent that it is affecting your peace of mind and your health, please reach out for personal support as well. You may want to chat to a friend or family member, your GP or to seek support from Lifeline on 13 11 14 or Beyond Blue on 1300 22 4636.

You can also seek support from the Australian government small business debt helpline: https://business.gov.au/expertise-and-advice/Small-Business-Debt-Helpline

.